Tax Bill Information:

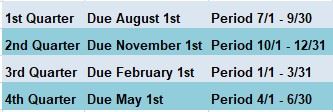

Real estate and personal properties bill run on a fiscal year basis and are mailed and due quarterly. The due dates are as follows:

The 1st and 2nd quarter bills are always preliminary bills based on the last fiscal year’s actual bill. The 3rd and 4th quarter bills are actual bills based on the recap and the budget being passed on time and a tax rate being set.

Note, any unpaid water and sewer charges for prior fiscal year not paid by mid-November will be added to the 3rd quarter actual real estate bill as mandated by Massachusetts General Law.

If you are a property owner who does not receive a tax bill, please send an email request to collectors@cityoflawrence.com and a duplicate bill will be mailed to you.

Abatements & Exemptions

Abatements and exemptions are applied to the February and May bills. If you think you may be entitled to an abatement or exemption, you can contact the Assessor’s office at 978-620-3190.